The Complete Guide to VA Loan Rates

Table of Content

And that lower rate can free up your monthly finances, too. A 0.25% reduction in rate saves about $40 per month on a $300,000 loan. Unchanged Rates are provided by our partner network, and may not reflect the market. You may be eligible for an IRRRL if you meet all of these requirements. Before sharing sensitive information, make sure you're on a federal government site.

In addition to a 30-year fixed, PenFed also underwrites a 15-year fixed program. PenFed, established in 1935, is now a credit union with a global presence, 24/7 account access, and is federally insured by the National Credit Union Administration . Veterans United claims to have closed more VA loans than any other lender in 2016, 2017, 2018, 2019, and 2020. The property on which the VA loan is used must be the borrower’s primary residence. Below are the most commonly asked questions about the VA cash-out refinance program.

Reasons to Avoid a Loan With a Balloon Payment

Included fees are the VA funding fee, appraisal fees, origination charges, title charges, discount points, and credit report fees. These expenses can be rolled into the loan amount on a VA refinance loan, but not on a VA purchase loan. The VA funding fee is a one-time payment that the Veteran, service member, or survivor pays on a VA-backed or VA direct home loan. This fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

You are a family member of a veteran who either went MIA, was a POW, died in the line of duty, or suffered a service-related condition. By refinancing an existing loan, the total finance charges incurred may be higher over the life of the loan. The mortgage industry calls this your “DTI” (debt-to-income ratio). You also have the option to buy a single-family home or a qualifying multifamily property with up to four units. However, if you received a bad conduct, dishonorable, or “other than honorable” discharge, you would not be eligible, although you can apply to the VA to upgrade your discharge status.

Can I use a VA loan to build a house?

These loans are available up to 100 percent of the home’s current appraised value. To establish the current home value, a new appraisal is required. In short, you can refinance any home loan into a VA loan with more favorable terms — regardless of the type of loan it is. The VA IRRRL, by comparison, is a VA-to-VA loan program only. You cannot use the IRRRL program if your current loan is FHA or any other type. VA-approved lenders can check eligibility, often within minutes, via direct online requests to the Department of Veterans Affairs.

Customers with questions regarding our loan officers and their licensing may visit the Nationwide Mortgage Licensing System & Directoryfor more information. We’ve compiled some of the most common mortgage rate questions below so that you can make more informed decisions. If credit is a concern, Veterans United offers a no obligation credit consulting service to help get you on the road to preapproval. You served for six creditable years or 90 days of active duty in the Selected Reserve or National Guard. You meet length-of-service requirements, generally 90 days in wartime and 181 days in peacetime. Rates drop during recessions and generally rise during good economic times.

About the VA funding fee

You apply for one with a bank, lender, or credit union, just like any other home loan. We pride ourselves in putting out customers needs first and want to get our Veterans and service members the best interest rates possible. In general, your credit history and your credit score are the biggest contributors to the best VA Loan Interest Rates.

On a 30-year jumbo mortgage, the average rate is 6.83%, and the average rate on a 5/1 ARM is 5.46%. The margin is a set percentage that is added to the index to determine your new interest rate. For example, if your index is 3% and your margin is 2%, your new interest rate would be 5%. If you’re a Veteran, you may be wondering what the current interest rate is on a VA home loan. We’ve got the answer, along with some tips on how to get the best rate possible.

Best VA Mortgage Rates for December 2022

The benefits of a VA loan are the same no matter which lender you choose. The key benefits of the program are no down payment requirement, no PMI requirement, and no prepayment penalties, with a VA funding fee taking the place of the PMI. If you have an eligible service history and decent credit, there’s a good chance you qualify for the VA cash-out program. Check with a mortgage lender to determine your eligibility and see how much cash you can take out. You can obtain a VA cash-out loan for up to 100 percent LTV, plus the VA funding fee.

I have a limited income and the rent I pay leaves a minimal amount to use to repayment. I need a home as my disability is gradually diminishing my mobility. Sure, it provides unmatched home buying advantages, but you can also use it to refinance your existing mortgage, whether it’s a VA loan or not. With that document, a VA-approved lender can request your VA Certificate of Eligibility for you, or you can request it directly from VA’s eBenefits website.

My credit score is not that great, and I’ve been working under the table because of my disability. Does this affect my chances of getting approved thru a bank? I just closed on my house and used a fantastic lender at USAA. I’m also a Remax Realtor that specializes in working with Veterans. I am now 100% disabled female single veteran that needs a home that can be made to assist my needs. I want to buy a condo that I can have made to meet my needs so I can live alone.

When you purchase discount points, you are essentially paying interest upfront to receive a lower rate over the life of the loan. Once your loan is set up, you can sign up for automatic payments. A VA cash-out refinance can pay off any loan, provided you are VA-eligible and meet cash-out mortgage requirements. For first-time use, the VA funding fee is equal to 2.3 percent of the loan amount.

Although they’re backed by the federal government, VA loans are offered by private lenders. That means you’re free to shop around and compare mortgage companies to find the lowest rate. You’ll want to keep closing costs in mind when refinancing a loan, as they can add up to thousands of dollars. Before you decide to refinance, divide your closing costs by how much you expect to save every month by refinancing to see if it’s worth it. While your lender can advise you on the costs and benefits of the transaction, you’ll want to be sure you understand what you’re getting into.

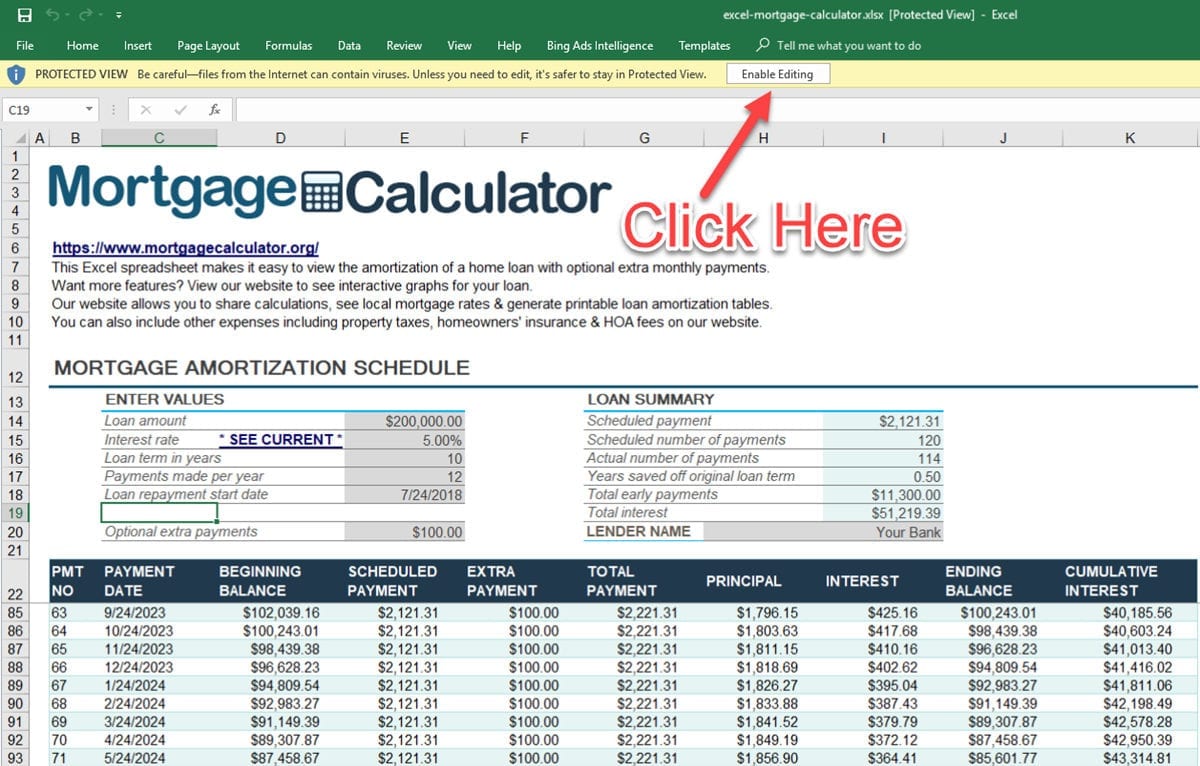

USDA loans do have income limitations, while VA loans are generally unrestricted in this aspect. If you’re looking to secure the best loan rate in 2020 without making a large down payment, it may be the right time to consider a VA loan. If you want to see how a VA loan can benefit you and your family, be sure to check out our helpful mortgage calculator. Additionally, a VA loan must be used on your primary residence and may carry additional fees if it’s not the first time you’ve used it.

Satisfying the Lender’s Requirements

On average, VA loans have the lowest rates of any major loan program. As of today, 30–year fixed VA loan interest rates start at 3.25% (3.431% APR), according to our lender network. For a conventional loan, that would be 3.625% (3.634% APR).

You receive VA compensation for a service-related disability. Either the house meets all the MPRs and gets approved by the appraiser, or the appraiser orders some repairs to be done before the closing. A VA loan appraisal is an assessment conducted by an appraiser to determine the property’s actual worth and ensure the property meets all of the MPRs. After getting preapproved, you can move onto the VA loan process and apply for the VA loan Certificate of Eligibility. The house must be a single dwelling that is legally considered to be real estate and is readily marketable. Here are all of the MPRs your property must meet to qualify for the loan.

Comments

Post a Comment