VA Loan Rates

Table of Content

It can depend upon several factors, including the number of times you have borrowed a VA loan. As stated above, it is not necessary to have an excellent score to qualify for VA loans. Instead, different lenders have different requirements for credit scores.

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well. Whether you are shopping for a car or have a last-minute expense, we can match you to loan offers that meet your needs and budget.

Today’s Mortgage Rates: December 12, 2022—Mortgage Rates Climb

Initially, the interest rate remains constant; however, after the initial term, the loan resets, and so does the loan interest. A VA funding fee is a one-time payment paid to Veteran Affairs to support the VA home loan program. Several factors could affect the monthly payments as shown on a VA calculator. However, these days, VA loans are no more expensive for sellers than any other type of loan. Yes, the VA offers jumbo loans to qualifying military service members.

That’s around $134,933 in total interest over the life of the loan. Borrowers with higher credit scores will usually qualify for lower interest rates than borrowers with lower scores. The location of the property may also affect the interest rate, as rates tend to be higher in areas with higher costs of living. The interest rate on a VA home loan is determined by a number of factors, including the lender, the length of the loan, your military service history, and your credit score. These factors all work together to give you an interest rate that is fair and competitive.

When should I use a VA loan?

If you’re eligible, try this VA mortgage calculator to see how much home you might be able to afford. A good VA loan rate for a 15-year fixed loan rate might be in the high-2% or low-3% range, while a good rate on a 30-year fixed loan might be in the 3–3.5% range or higher as of Feb 2022. At this point, you’d have to be very lucky to find a 30–year fixed rate below 3% . An FHA loan, also known as a Federal Housing Administration loan, is another form of mortgage loan backed by the U.S. government.

Generally, VA loan terms range between 15 years, 20 years, and 30 years. Choosing a short loan term increases your monthly payments significantly. However, it also reduces the interest rate, which helps you save thousands over time. Selecting an extended loan term will decrease your monthly payments but raise your interest rates.

VA Loan Rates

If you’re willing to pay a higher interest rate, you may be able to qualify for a larger loan amount or get better terms . There are a number of factors that go into determining the interest rate on a VA home loan, such as the veteran’s credit score, employment history, and debt-to-income ratio. However, one of the most important factors is the type of loan you choose. You can apply for a VA loan more than once, but the funding fee increases when using a VA loan after your first time. The VA funding fee is a one-time charge that you pay when you get a VA-guaranteed mortgage to purchase or refinance your home. In many cases, you’ll have the option to roll the VA funding fee into your loan.

Turn your home equity into cash and reduce your mortgage rate at the same time. Discount points allow you to buy yourself a lower interest rate by paying more money upfront, at closing. As with a down payment, this is an option more accessible to borrowers with more money available at closing. Once you’ve done that, if you’re able, look at your installment loans. These days, most can be paid early without incurring a prepayment penalty. Confirm this with your lender before you make any early payments.

How to compare mortgage rates?

A VA home loan is generally considered jumbo when the loan amount is above the county-specific loan limit. VA jumbo loans allow access to homes in high-cost metro areas. Most of those obligations will be debts, including auto loan payments and minimum credit card payments. The difference or “spread” between rates changes every day.

The typical funding fee ranges from 1.4% to 3.60% of the loan amount. USAA offers military members and their families a comprehensive range of financial products and services that are competitively priced. It offers benefits, insurance, advice, banking, investment products, specialized financial resources, and member discounts. Like other lenders, once you are pre-qualified you will apply for your Certificate of Eligibility online. PenFed will order an appraisal of the home you want to buy and then review the appraisal result when it’s ready alongside your credit and income information.

Before applying for a mortgage, check your credit score and get a copy of your credit report from each of the three major credit bureaus by visiting AnnualCreditReport.com. If necessary, take steps to improve your credit such as paying bills on time, reducing your credit card balances and not applying for new credit. Use FICO's Loan Savings Calculator to see how even a small boost in your credit score could save you thousands of dollars over the life of your mortgage. A shorter term — for example, 15 years instead of 30 years —may result in savings because interest accrues over a shorter time with a quicker payoff. Mortgage lenders may offer lower interest rates for shorter terms.

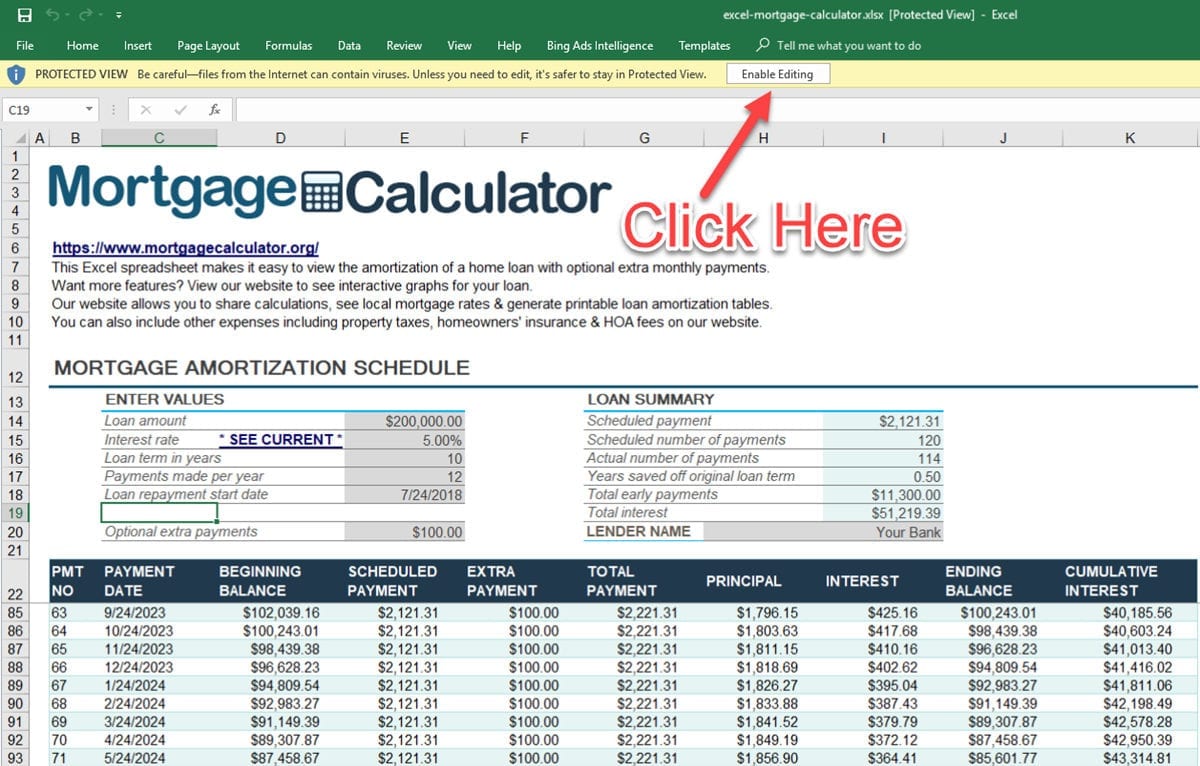

Enter the expected cost of the house and the amount you are willing to make as a downpayment. However, putting money down upfront would reduce your monthly payments. VA loans are consistently the lowest among all the major mortgage programs. If you’re eligible for a VA loan, it’s highly likely you’ll save a lot of money by getting one.

When you receive lender credits in exchange for a higher interest rate, you pay less upfront but pay more over time because of the higher interest. Discount points are optional fees paid at closing that lower your interest rate. Essentially, discount points let you make a tradeoff between your closing cost fees and your monthly payment. By paying discount points, you pay more in fees upfront but receive a lower interest rate, which lowers your monthly payment so you pay less over time. Any discount points purchased will be listed on the Loan Estimate.

Some of the offers on this page may not be available through our website. These include fixed-rate and adjustable-rate conventional loans, jumbo loans for higher-value properties, and government-backed loans from the FHA, VA, and USDA. Besides getting your primary mortgage, you may want to consider some other types of loans during the home buying process. These can provide needed cashflow to help make your purchase go smoothly, or other financing options for those with certain home-buying needs. The program has an income cap for eligible borrowers that varies by region and family size. These programs are typically available through private mortgage lenders — many of the same lenders that offer conventional or jumbo loans.

With a conventional mortgage, borrowers usually have to pay private mortgage insurance every month when they put down less than 20%. With a VA loan, you’ll never pay PMIno matter how small your down payment—even if you put nothing down. Assess your needs to determine if you currently require and qualify for a VA loan. NFCU’s exclusive Home Squad and Realty Plus programs assist you with your loan, finding a real estate agent, title services, and loan services through the life of the loan. Realty Plus matches you with a local, specially trained real estate agent and gets you $400 to $9,000 cash back on your loan. It offers Freedom Lock, which allows you to lock in new, lower rates at no cost, no PMI requirements, and no down payment.

Comments

Post a Comment