What is the Interest rate for VA loan

Table of Content

This means that the VA will either pay 25% of the loan amount or $36,000 to the lenders if the borrower defaults in any way. The VA mortgage limit is the maximum amount the Department of Veterans Affairs can provide without any down payment. With the pre approved amount determined, you can shop for a house that not only fits your budget but also meets the requirements of the VA . You cannot purchase a VA loan for an investment property or a vacation home.

Finally an adjustable-rate mortgage may be a good option to buy when interest rates are high. The borrower will save money with the ARM’s lower interest rate, and may be able to refinance to a fixed-rate loan if rates drop in the future. Different from a fixed-rate mortgage, an adjustable-rate mortgage has a stable interest rate for a set period of time (for example, the first five or seven years of a 30-year loan). After that, the rate will adjust based on market conditions . If you’re getting a VA loan, you already have a head start on getting a great deal. VA loans typically offer the lowest rates of all mortgage options.

How will I pay this fee?

With an interest-only mortgage, the borrower pays only the interest for the first several years of the loan. This results in a lower monthly payment than with a conventional loan. After the interest-only period ends, the borrower pays both the interest and principal. An interest-only mortgage may be a good option for people who move every few years, or who are buying a home as a short-term investment.

The interest rate is just one fee included in your mortgage. You’ll also pay lender fees, which differ from lender to lender. Both interest rate and lender fees are captured in the annual percentage rate, or the APR. This week the APR on a 30-year fixed-rate mortgage is 6.82%. Third, keep in mind thatInterest rates on VA home loans are generally lower than conventional loans – but they’re not always the lowest available.

How many different types of mortgages are there?

You may be eligible to buy a home using a VA home loan, even if you served long ago. You should be in close contact with your real estate agent and VA loan lender when putting together a sales agreement. They will provide you the necessary instructions for signing and submitting to the seller. You cannot purchase a vacation home or an investment property with these loans. You are thinking of paying off the loan before the loan terms reset.

If your FICO is 640 or higher, you’ll probably b okay with some VA lenders. Even if it’s lower, you might be able to get a loan — it depends on how old your credit problems are and how severe your blemishes are. VA typically charges a funding fee to defray the cost of the program and make home buying sustainable for future Veterans. The fee is between 0.50 percent and 3.3 percent of the loan amount, depending on service history and the loan type. Shop around at various lenders, because each will have its own stance on past credit issues.

The Best Time to Get a VA Home Loan

The large supply of lenders on LendingTree provides the borrower with more choices to compare. Department of Veterans Affairs for veterans and active service members to use to purchase a home to live in as a primary residence. These loans are affordable, come with little to no down payment, and no private mortgage insurance. Lenders can offer low-cost loans through the VA lending program because the Department of Veterans Affairs provides a guaranty for part of your loan’s value. The lender would be compensated if you couldn’t repay the loan. Conventional loans don’t offer this guaranty, and thus need to charge expensive private mortgage insurance to protect lenders from financial loss.

You also can use your VA loan benefits more than once during your lifetime. The length of the loan term will also affect the interest rate. VA home loans are available in 15-, 20-, 25-, and 30-year terms. In general, shorter loan terms will have lower interest rates than longer terms.

Points are generally more advantageous to borrowers who plan to own the home for a longer period of time. Your loan officer can help you determine the break-even point of purchasing discount points, or if points even make sense for your specific situation. When you purchase discount points, you are essentially paying interest upfront to receive a lower rate over the life the loan. A VA loan professional will talk with you honestly about your income, credit history, employment, and other details to pre-qualify you for your loan. All documents must be reviewed and approved by underwriting before a loan can be finalized.

A VA cash-out loan can pay off and refinance any loan type, including an FHA, USDA or conventional loan with a fixed or adjustable rate. You can use this refi program to get out of a loan with a high rate or one that has mortgage insurance. The Department of Veterans Affairs does not set mortgage rates. Your lender will determine the rate on your VA loan based on market rates, your credit profile and your financial situation. You may qualify for a lower interest rate if you choose to make a down payment. Generally, they require information like interest rate, taxes, loan limits, VA funding fees, insurance, and downpayment .

Yes, your credit score will determine your interest rate for any loan. Even though the VA doesn’t specify a minimum credit score for VA loans, many lenders won’t accept scores below 620. When applying for a VA home loan, the most important factor is how you’ve handled your rent or mortgage payments in the past. Mortgage rates overall are currently at an all-time low due to nationwide economic issues stemming from the coronavirus pandemic. However, due to the already-low nature of VA home loan rates, VA mortgage rates have experienced little change over the last couple of months. The average VA loan interest rate as of July 8, 2020 is 2.5% for a 30-year fixed mortgage.

The higher the fees and APR, the more the lender is charging to procure the loan. The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges. With rare exceptions, you won’t qualify for a conventional mortgage with a credit score lower than 620, no matter the lender. You also don’t have to make a down payment and you don’t have to pay PMI, an extra fee that borrowers with small down payments using conventional loans normally pay every month for years. Interest rates can change daily, so it’s important to compare rates from multiple lenders before committing to a loan.

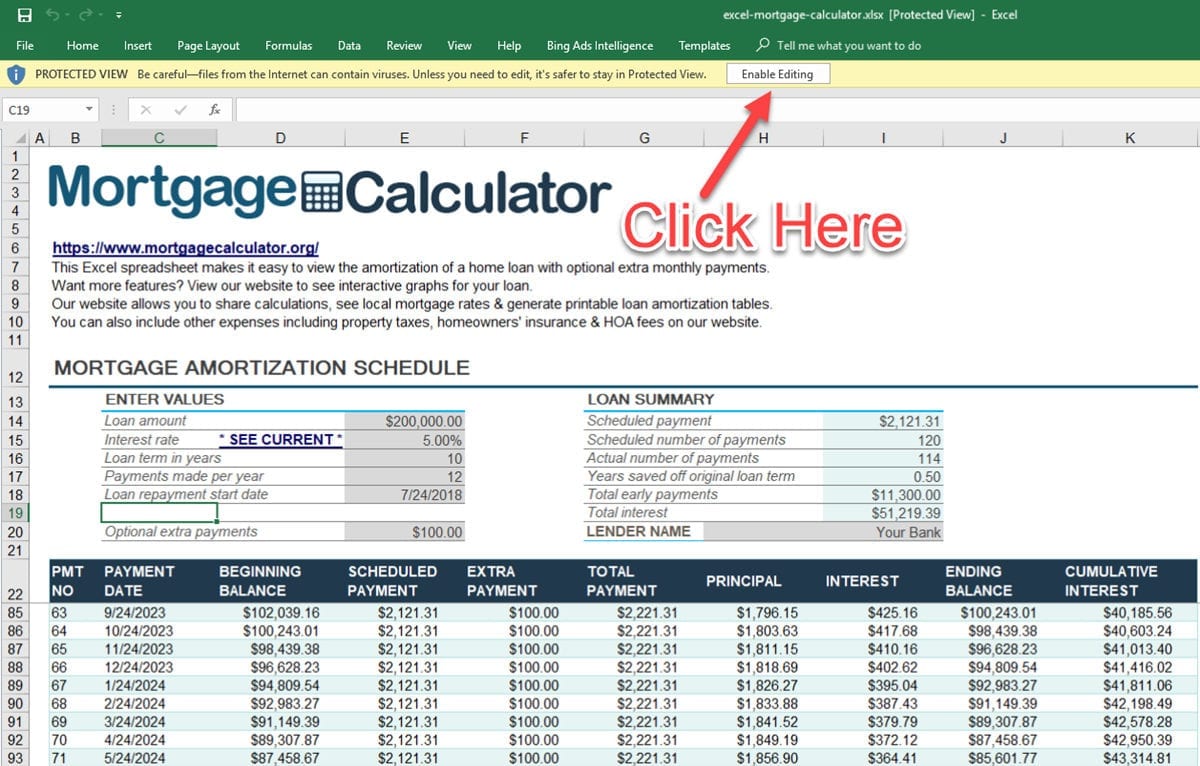

Now, we apply our 6% interest rate to get a new monthly principal and payment of $1,834.62 – again, a 6.00% NOTE rate. Review the VA funding fee rate charts below to determine the amount you’ll have to pay. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. You may be eligible for a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing. Currently I am in two separate repayment programs for those with defaulted student loans.

Comments

Post a Comment